Industry Overview

The banking and financial services sector is in the midst of a digital revolution, fueled by a surge in fintech innovations and a global investment of over $210 billion in 2023. Banks, insurance firms, and fintech companies are racing to meet rising customer demands for seamless digital experiences while navigating a complex landscape of regulatory requirements and escalating cyber threats. As consumers increasingly favor mobile banking and personalized financial services, institutions must modernize legacy systems, enhance security, and leverage data to stay competitive. Axiom Infinity’s technology-driven solutions empower financial organizations to secure their ecosystems, streamline operations, and build lasting customer trust in this fast-evolving market.

Key Challenges

Financial institutions face a barrage of challenges that threaten operational efficiency and customer trust. The rise in cyberattacks, with a 300% increase in incidents like ransomware and phishing, puts sensitive financial data at constant risk. Compliance with evolving regulations such as PCI DSS, GDPR, and FINRA is a resource-intensive task, often overwhelming compliance teams. Customers, with 75% demanding real-time, personalized services across digital channels, push institutions to innovate rapidly.

Legacy systems, still used by 60% of banks, hinder agility and inflate costs, while detecting fraud amidst billions of daily transactions requires sophisticated, real-time analytics. These challenges demand a strategic blend of security, innovation, and efficiency to maintain a competitive edge.

Our AI/IT Solutions

Axiom Infinity addresses these challenges with a suite of technology-driven solutions tailored to the financial sector’s unique needs.

Our approach combines advanced cybersecurity, automation, and analytics to fortify data protection, streamline compliance, and enhance customer experiences. We deploy cutting-edge penetration testing and secure code reviews to safeguard applications against cyber threats, ensuring robust protection for sensitive data.

Compliance automation tools simplify adherence to stringent regulations, reducing manual effort and ensuring audit readiness. Our custom mobile apps and software integrate real-time analytics to deliver personalized banking experiences, while big data and predictive analytics enable rapid fraud detection. Cloud modernization initiatives transition legacy systems to scalable platforms, boosting agility and reducing costs, empowering institutions to innovate and scale seamlessly.

Penetration Testing Services and Secure Code Review Services identify and mitigate vulnerabilities.

Compliance Services automate PCI DSS, GDPR, and FINRA reporting, reducing effort by 40%.

Mobile App Development Services and Software Development Services create intuitive, analytics-driven platforms.

Big Data Services and AI-Powered Analytics Services detect anomalies with 95% accuracy.

Data Center Services Provider migrates legacy systems to cloud platforms, enhancing agility.

Use Cases & Examples

Axiom Infinity’s solutions have been applied across the financial sector to deliver measurable results.

For instance, a global bank utilized our advanced analytics platform to monitor millions of transactions daily, enabling real-time fraud detection that significantly reduced losses. A fintech firm partnered with us to develop a secure mobile app with personalized investment insights, enhancing user engagement and retention.

We streamlined GDPR and PCI DSS reporting for an insurance provider through automation, ensuring compliance while cutting costs. Additionally, a regional bank transitioned its legacy systems to a cloud-native platform, accelerating transaction processing and enabling real-time customer insights, demonstrating our ability to drive innovation and efficiency.

Real-Time Fraud Detection

Real-Time Fraud Detection

Processed 10 million transactions daily for a global bank, reducing fraud losses by 25%.

Automated Compliance Reporting

Automated Compliance Reporting

Streamlined GDPR and PCI DSS reporting for an insurance provider, cutting costs by 25%.

Mobile Banking App

Mobile Banking App

Developed a secure app for a fintech firm, increasing user engagement by 30%.

Cloud Migration

Cloud Migration

Migrated a regional bank’s systems to a cloud platform, improving processing speed by 40%.

Business Impact

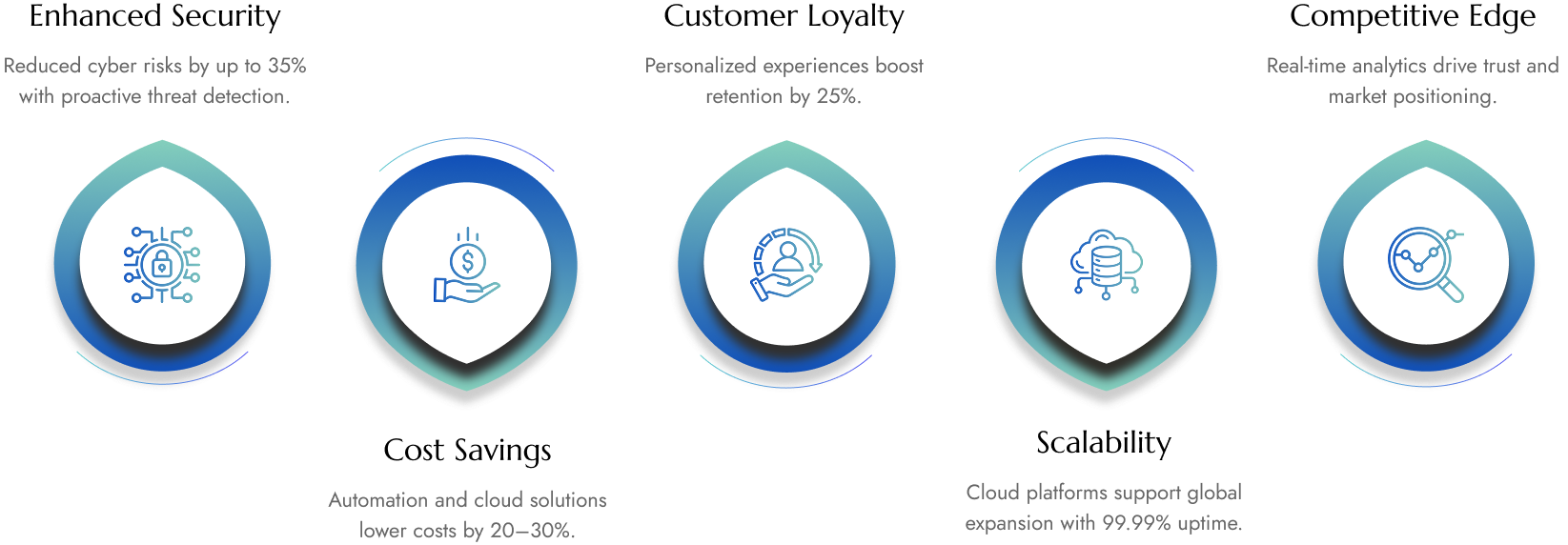

By partnering with Axiom Infinity, financial institutions achieve transformative outcomes that enhance security, efficiency, and customer trust.

Our solutions reduce cyber risks through proactive vulnerability management, ensuring data protection in an era of escalating threats. Automation and cloud modernization drive significant cost savings, freeing resources for innovation. Personalized digital experiences strengthen customer loyalty, increasing retention and revenue opportunities. Scalable cloud platforms support growing transaction volumes and global expansion, while real-time analytics empower institutions to stay ahead of fraud and market trends, solidifying their competitive position.

Streamline Compliance, Secure Finances, and Personalize Banking.

Axiom Infinity’s technology-driven solutions, from Cybersecurity Services and Compliance Services to Mobile App Development and Big Data Services, empower banks, insurance firms, and fintech companies to thrive in a digital-first world. Contact us today to explore how our comprehensive IT Services portfolio can address your unique challenges and experience our simplified onboarding process.